Paying off your entire balance lowers that ratio even more and can help you avoid paying credit card interest.Įvery card issuer has its own reporting schedule, so it’s best to ask your issuer about its practices. Paying down your balance may help you improve your credit score because it lowers your utilization ratio. Credit use: Another factor that impacts your credit scores is your credit utilization ratio, which measures how much available credit you’re using.Payment history: Making on-time payments shows responsible credit card use and may help you improve your credit.Paying your bill on time can also have a positive impact on two areas that affect your credit scores: You’ll want to make at least the minimum payment by the due date to keep your account in good standing and to avoid late fees. And that due date will be the same date every month.Ĭredit card issuers are also required to give you at least 21 days between the date your statement is mailed or delivered and the date your payment is due. At the end of the billing cycle, your issuer will send you a credit card statement that lists your account activity, the minimum payment due and a due date. Online bill pay : Sign in to your credit card account, and provide your bank account details to make a payment online.Įvery credit card has a billing cycle that typically lasts about a month.You’ll just need your payment account details. Mobile bill pay: Some credit card issuers offer a mobile app you can use to pay your bill.Just remember to allow plenty of time for your payment to reach the issuer before the due date. Or you can follow the instructions on your credit card statement to mail a check with your credit card bill. Check: If your issuer accepts this form of payment, you can drop off a check in person.Cash: If your credit card issuer has a location nearby, you may be able to pay in person with cash.You’ll likely need to provide your credit card account, bank account and routing numbers.

But you may also be able to pay in person or by calling the phone number on the back of your credit card. You can usually make this transfer online using your bank’s mobile app or website. ACH transfer: Automated Clearing House (ACH) payments let you transfer funds directly from one account to another.All trademarks used herein are owned by the respective entities.Depending on your credit card issuer, you may be able to pay your credit card bill via ACH transfer, cash, check, a mobile app or an online portal. To learn more about how Capital One collects, uses, and protects your personal information, review our privacy policy at capitalone.ca/privacy.Ĭapital One is a registered trademark of Capital One Financial Corporation, used under license. Our strong encryption technology protects the privacy and security of your information, both for online banking and within our app. Plus, turn on notifications to stay on top of your account activity, like when payments are due, posted and past due. Current rewards balance (if applicable).

Current credit card balance, available credit, payment amount and due date.With the Capital One Canada app for iOS, you can view: Enable Face ID or Touch ID to access your account seamlessly.

Capital one credit login password#

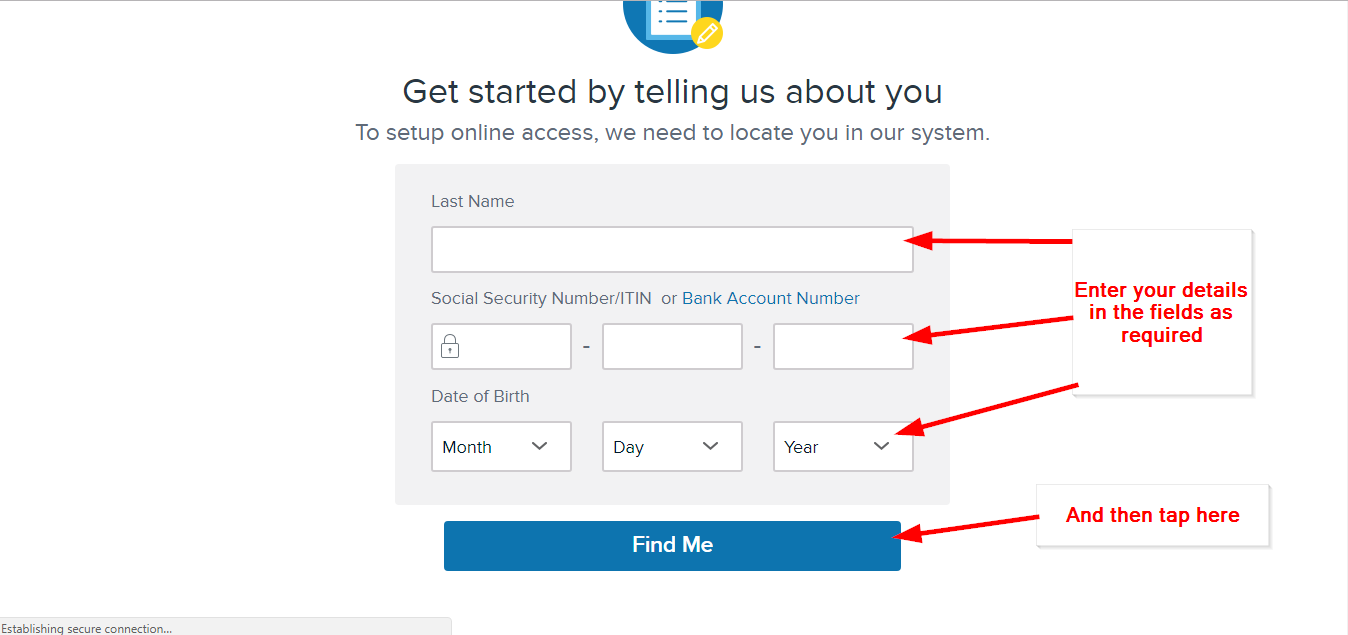

Simply use your existing Capital One online banking username and password to get started. Manage your Capital One® credit card anywhere.

0 kommentar(er)

0 kommentar(er)